Inside the Insurance Institute for Business & Home Safety’s hail lab, lab technician Michelle McClain loads a 3D-printed hailstone into a cannon. She’s running a simulation on a patch of IBHS-certified roof.

The goal is to create a roof that can guard against wind and water penetration. She fired the hail cannon, and the hailstone bounced off a shingle.

“With this particular impact, you can see that dent clearly,” said IBHS researcher Chris Sanders.

The cannon fired the hailstone over 60 miles per hour to replicate the kinetic impact of real hail.

“We’re just looking for … will water potentially penetrate through this?” Sanders said.

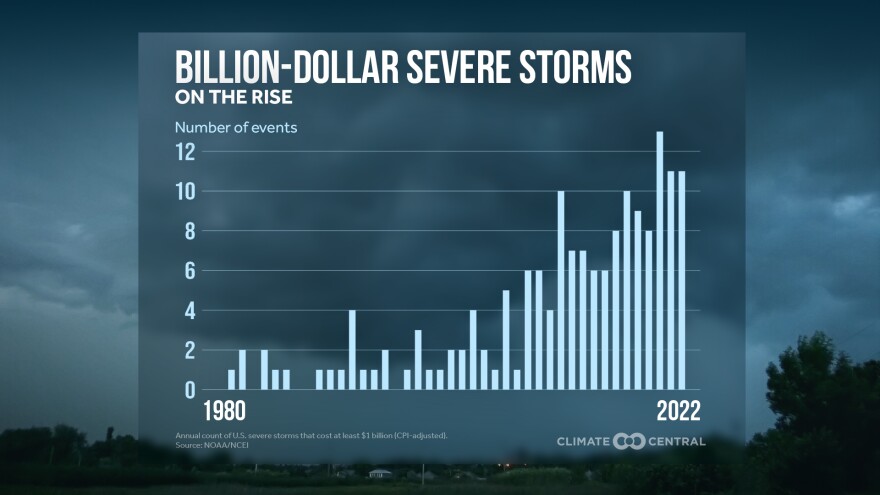

Climate change is a big driver of higher costs for insurance companies. When storms happen, they’re often bigger, wetter and windier. That trend is only going to continue in a warming world.

Last year, Nationwide dropped over 10,000 policies in eastern North Carolina due to the projected cost of insuring weather-related losses, according to a report from the Raleigh News and Observer. Even when companies stay, the cost of insurance continues to rise.

In 2020, the North Carolina Rate Bureau requested a 24.5% rate hike and got an average 7.9% increase. Now, there’s a 42% rate hike request on the table. The companies and Insurance Commissioner Mike Causey are in negotiations.

The North Carolina Insurance Underwriting Association, a state-regulated nonprofit commonly referred to as the Beach Plan, has done something unusual to combat the rising cost of storm claims — for an insurance company, anyway. It started paying policyholders to upgrade their homes in the hopes of reducing future claims.

“Our goal is always to try to increase surplus during periods of low storms so that we have enough cash on hand to pay for the storms,” said Gina Hardy, CEO of NCIUA.

That surplus has also gone toward a grant program that helps homeowners pay for an IBHS-certified roof. The Beach Plan covers 18 counties in eastern North Carolina, insuring risks that the private market won’t and writing over 60% of homeowners’ or wind insurance policies in the Outer Banks. It insures about half in the other coastal counties.

The nonprofit started offering customers an IBHS-certified roof upgrade when they needed major roof replacements during a claim in 2016.

Since then, roofers have upgraded over 10,000 roofs.

Growing program

On Tuesday, the Beach Plan launched a new program in the Outer Banks that covers up to $10,000 to install stronger roofs preemptively. Before noon, the program had already received over 700 applicants.

“This program here is about the best thing I know of around our area,” said Shannon Phillips, mayor of Sunset Beach, near the South Carolina border.

Phillips owns his own roofing company, HD Coastal Ltd. He has installed IBHS-certified roofs on over 250 homes during the last five years.

Usually, insurance providers only pay after a claim has been filed. But investing in homes before damage occurs can lead to fewer claims down the line.

A 2021 report by the Institute for Advanced Analytics found the chance of a policyholder filing a claim decreased 34.5% after installing a FORTIFIED roof — that’s the name of the IBHS certification.

“It’s almost like insurance for the insurance is what I call it, cause they’re spending the extra money to protect the future,” Phillips said.

‘Insurance for the insurance’

The new roofs resulted in 22.7% less damage reported on storm-related claims, according to Hardy. Those savings led to the creation of a grant program in 2019 that residents can apply for whenever they want to re-roof their homes — not just after a storm.

However, providing money before a disaster strikes isn’t something that private insurance companies do.

“Grants are something that’s done at the state level,” said Mark Friedlander, who directs communications at the Insurance Information Institute, a nonprofit research organization. “Insurers don’t provide grants.”

Friedlander said insurance companies along the coast of North Carolina do offer discounts for homeowners with IBHS-certified roofs — as mandated by state regulators. Big insurance companies like Nationwide and State Farm have also started offering free electrical-fire sensors, but they don’t provide anything like NCIUA’s grant program.

“What they’re offering is counsel, advice, tips on how consumers can take simple steps to make their homes more resilient,” Friedlander said.

But investing in helping policyholders fortify their roofs before the storm has added up during the last five years.

“We have found storm after storm after storm, they perform better than even brand new code roofs,” said Don Hornstein, a professor at the UNC-Chapel Hill School of Law and member of the NCIUA’s board of directors. “And we save money doing it. We save money as an insurance company.”

Private insurers must also cover the higher cost of construction materials and building supplies and buy insurance, called reinsurance, from larger insurers. Those rates are affected by the global effects of climate change and rose by as much as 50%, according to reporting by Reuters. These factors also impact the Beach Plan, which cannot pull out of high-risk areas or enter into a consent-to-rate agreement but continues to maintain a surplus each year without tapping North Carolina insurers for additional funds.

But with fewer claims from homes with IBHS-certified roofs, the nonprofit insurer has had to purchase less reinsurance.

“Between you and me, I would rather the money go to regular roofers in North Carolina and circulate at the North Carolina coast than give it to these fancy people — who are wonderful but fancy nonetheless — all around these quants and hedge funds,” Hornstein said.

‘Insurer of last resort’ prepares homes for worsening climate disasters

As the Rate Bureau makes its case for increasing homeowners’ insurance rates, attorney Marvin “Mickey” Spivey pointed to NCIUA’s market share as a sign that current rates are inadequate.

“Rather than being the insurer of last resort, as it is legislatively intended to be, the Beach Plan is writing the vast majority of insurance on the beach and coast for wind losses,” Spivey said during a hearing in early October.

The Beach Plan’s market share has increased recently as private insurers wrote fewer policies due to natural disasters outside the state. From 2022 to 2023, the nonprofit’s market share increased to 64% for the coastal area. That’s still down 16% from its peak in 2013, according to Hardy.

“We absolutely encourage private markets, and we're hoping that with stronger homes, that we might see our market share decline,” Hardy said.

Rate Bureau attorney Spivey said that the people of North Carolina are the backstop for the Beach Plan, which means that if something catastrophic happens, all policyholders in North Carolina would pay for it.

“If a major hurricane hits North Carolina here, or if even multiple minor hurricanes hit us in a single year, the Beach Plan's losses would very likely mildly exceed their surplus and reinsurance,” Spivey said.

Private homeowners’ insurers pay into the Beach Plan based on their share of the market.

When a catastrophic event like Hurricane Floyd in 1999 occurs, the Beach Plan taps those private insurers to help pay for the claims — in 2008, the N.C. General Assembly capped the amount private insurers were on the hook for at $1 billion.

“If we don't have enough money in the bank, we next can send a letter to every one of the insurers in North Carolina, whether they write at the coast or not, and for that next billion in losses, they are responsible within 30 days to give us their share of that billion,” Hornstein said.

The Beach Plan also purchases reinsurance in the event claims exceed both its surplus and the money it can request from North Carolina insurance companies. However, the Beach Plan hasn’t tapped its member insurers since Floyd. When Hurricane Florence struck the coast in 2018, the nonprofit insurer used its surplus to pay the $1.5 billion in claims. Hardy said the nonprofit could easily finance another Floyd and Hazel, which caused $6 billion and $136 million in damages, respectively, without maxing out its reinsurance and catastrophe bonds.

That hasn’t stopped North Carolina's private insurers from acquiring reinsurance against future assessments by the NCIUA during the last few years, according to testimony by Paul Anderson, a consulting actuary for the N.C. Rate Bureau, during October’s rate case proceedings.

If the last couple of years have made anything clear, there’s no avoiding the impacts of climate change. Last year, insurance companies paid out massive claims in the Midwest due to severe thunderstorms.

The same can be said for the rest of the world.

“All over the planet, the climate is worsening,” Hornstein said. “Reinsurance rates have skyrocketed, and that has trickled down to regular policyholders because their insurers have to lay off some of their risk to reinsure, or they'd go broke.”