It seems almost everyone has had a surprise medical bill. They can range from the hundreds, to even thousands of dollars. In some cases, they are financially ruinous. Growing attention to the business side of health care has led experts and even some doctors to recommend patients don't pay the first bill they receive, and to ask for itemized bills in detail when hospital billing departments call.

"You can fight back and win," says Marshall Allen, formerly an investigative reporter into the business of health care who recently wrote a book titled, Never Pay The First Bill: And Other Ways To Fight The Health Care System And Win. "Because when you push back, you can save hundreds or even thousands of dollars per health care interaction."

Following a Trump Administration rule that went into effect January 1, hospitals must now post detailed price and negotiated rate information online for 300 procedures, or what are labeled "shoppable services." In an executive order signed July 9, President Joe Biden affirmed that he would continue to enforce these rules, a signal of broad bipartisan support for the measure.

An investigation by North Carolina Public Radio - WUNC and WRAL-TV found broad price differences for the same services depending on insurance plan and hospital, and that while hospitals in the Triangle are following the rules better than those in some parts of the nation, big information gaps still create blind spots for consumers who want to effectively shop for health care services.

The new mandate requires hospitals to post significantly more granular data than ever before, including not only charges, but the actual reimbursement rate that will be paid by various health insurance plans.

"I see it as a massive breakthrough. A huge breakthrough," said Allen.

"Where they are doing this, it is a total game changer," Allen, who in July began working for the Office of Inspector General, added.

But so far, few hospitals have fully complied. A study of 100 randomly selected hospitals published in a June research letter in JAMA Internal Medicine found just 17% fully complied. Even after the Centers for Medicare and Medicaid Services began sending warning letters in May, industry analysts found low rates of full compliance among the country's biggest hospitals.

Elsewhere, the nonprofit group Patient Advocate Rights conducted a semi-annual survey examining compliance of the new federal law. Of the 500 randomly selected hospitals, the group found 29 - or 5.6% - are fully compliant. The report names 10 North Carolina hospitals and found Vidant Medical Center is the only one providing complete transparency as the mandate instructs.

"Because right now, nobody's holding them accountable and that's why they're getting away with not releasing the prices," said Dr. Jenaya Calderilla, a California-based physician and patient advocate.

Transparency in the Triangle

In the Triangle, Duke Health, UNC Health Care, and WakeMed Health all posted some information, but Duke lists only price ranges of negotiated rates for services, not a full breakdown by insurer. WakeMed's online portal lags significantly, and downloaded files contain error messages. The Centers for Medicare & Medicaid Services had not responded by deadline as to whether any of these health systems received warning letters pertaining to how they posted data.

Where some comparisons appear to be possible, broad price differences emerge. A cesarean section without complications for a patient with one kind of plan from United Healthcare will cost just under $3,000 at Duke University Hospital, but nearly $14,000 at Rex Healthcare in Raleigh. A patient with one kind of plan from Aetna would pay nearly $15,000 at WakeMed North.

It's really this business side of the medicine that's inserted itself between the doctors and the patients. Glommed on to the trust, we put in (clinicians) and created this facade that makes us think that we should trust them, too. And that we shouldn't ask questions of them, too. And that they only have our healing and our best interests at heart. That's just not the case.Marshall Allen

Depending on the insurance plan, a patient at UNC Hospital could pay as little as $58 or as much as $327 for a basic X-ray. Across the Triangle's largest hospitals, the negotiated rate for a colonoscopy runs from $504 to $5,397.

But this doesn't give the full picture. A hospital bill will almost always include more than the cost for a procedure, and these prices also don't give the patient any information about what the out-of-pocket costs will be, though patients can sometimes get estimates directly from their own health insurance provider.

"Because with high-deductible health plans, even though you're staying in network, you may have to pay out of pocket for a certain time until you hit your deductible," said Robin Gelburd, president of FAIR Health, which operates a database of more than 34 billion claims that it uses to estimate what a hospital will charge, and what a consumer might pay depending on when and where the patient gets a procedure.

She and other advocates support the new disclosure requirements, but even if every hospital complied fully, consumers would still need help.

"Providing cost information in the health care system, particularly to consumers, patients, caregivers and families, is really equivalent to giving them the keys to a new car. And if you're going to do that, you really need to give driver's ed. You cannot just give out that information and expect people to know how to navigate on the roads of the health care system."

Where You Get A Procedure Matters… A Lot

While this new data would ideally allow consumers to better comparison shop between hospitals, it still leaves out any comparisons to other kinds of facilities, notably ambulatory surgery centers that often have far lower facility fees.

"The biggest driver of costs is the building where you get it," said Bill Kampine, the co-founder of Healthcare Bluebook, which analyzes true costs of health procedures. "There is not a tremendous amount of variation in the physician piece of it."

While some ambulatory surgery centers post prices online, particularly if they are lower than surrounding hospitals, they are not required to post them in the same way that full-service hospitals are now required, so easy comparisons are still elusive.

These facility fees cover costs associated with some of the high level equipment found only in major teaching hospitals. But advocates argue that for many routine procedures, that equipment would never come in to use, so having a routine procedure can be done in care settings other than major hospitals.

"A community hospital with a good doctor and a good operating room team can do a high quality knee replacement, just like a marquee, high-dollar medical center can," said Allen.

A Trump Era Rule Endorsed By Biden

The bipartisan-supported Trump-era bill was brought forward in an effort to "increase price transparency, empower patients, and increase competition among all hospitals and insurers." It has been legally challenged by hospital and insurance lobbyists.

However, some advocates argue that increased transparency could actually negatively affect the mental health of people seeking medical care.

"I think it actually could add to stress because people are gonna know well, this is gonna cost me this and I need it and I know beforehand that I'm going to go into medical debt," said Rebecca Cerese, the health engagement coordinator for the Health Advocacy Project of the North Carolina Justice Center.

Research from the Journal of the American Medical Association shows, as of June 2020, an estimated 17.8% of Americans had medical debt. Nationwide, and the average amount owed was $429.

Advocates generally agree that reporting standards will improve, allowing patients to better comparison shop and find cheaper options. Already, third-party groups like Turquoise Health have begun to scrape the data to post things in more user-friendly ways. Still, the price doesn't give information about quality. Medicare publishes star ratings for many hospitals to help patients make quality-of-care comparisons. WakeMed and UNC Hospital each have 3 stars, Duke has 4 stars, and Rex Healthcare is the only 5-star rated hospital in the Triangle.

But quality can vary within a hospital as well, depending on the doctor and nursing staff on any given case. A 2015 ProPublica investigation discovered sometimes wide disparities in outcomes from the same hospital. These aren't trivial decisions. According to a Johns Hopkins report, medical error accounts for 250,000 deaths each year, the third-leading cause of death in the United States.

Allen, who wrote the how-to book to help patients lower incorrect medical bills, says he is optimistic about the new data, and how it might help empower consumers. There are more than 150 million people in the United States with employer-based health insurance, including 5.4 million in North Carolina, who can use the new pricing guide to effectively shop for care. He acknowledges it can seem daunting at first, but that it's easier to challenge an unfair system than it might seem. And even if just 1% or 2% started fighting back, it would put pressure on the system.

"That would be an overwhelming number of patients," he said. "You'd be looking at about 2 million patients who would be creating so much havoc - fairly - by standing up for themselves, that I think it would give the hospitals and the health care system the incentive they need to treat us fairly."

Hospital Finances

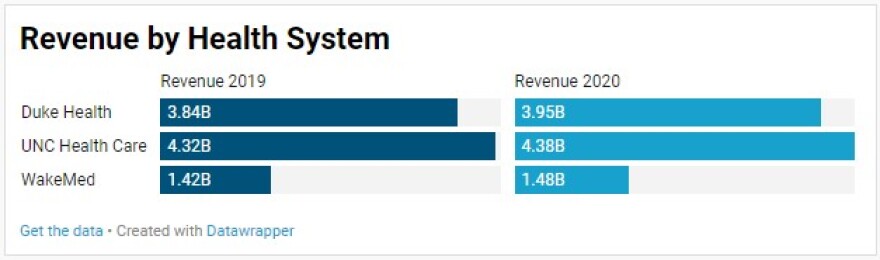

Over the past few decades, especially as consolidation has reduced competition in some areas, health systems have become major businesses, with the hospitals often working as the big profit engine.

In fiscal year 2018-2019, Duke Health reported $261 million of operating income, UNC Health Care reported $270 million, and WakeMed Health reported $42 million, according to audited financial statements.

While operating incomes were down in fiscal year 2019-2020, which includes months of fighting the COVID-19 pandemic, the hospitals each still posted between $85 million and $134 million of net income, largely due to strong non-operating performances, like investments for instance, according to audited financial statements.

Because these hospitals provide public benefit, nearly all of this is tax-exempt. That public benefit can include various investments in communities surrounding the hospital, and often is reflected in what hospitals refer to as "charity" or "uncompensated" care. This is health care they provide to patients who cannot afford their full bills, or a calculation of the price of care not covered by public insurance like Medicare or Medicaid.

Allen argues that the skyrocketing cost of health care has little to do with the frontline workers who provide care.

"It's really this business side of the medicine that's inserted itself between the doctors and the patients. Glommed on to the trust, we put in (clinicians) and created this facade that makes us think that we should trust them, too. And that we shouldn't ask questions of them, too. And that they only have our healing and our best interests at heart," he said. "That's just not the case."

Patient Advocates Reaching Gen Z On Tik Tok

Jenaya Calderilla makes TikTok videos about the health care industry and how it can oftentimes feel upside down.

"In order to really truly help my patients, I had to get involved with some of the finances," Calderilla, a California-based physician and patient advocate, said.

Calderilla and her videos have millions of views. In March, a series of videos about hospital billing went viral. The series starts with her getting a bill for $20,000. It's not real, she's just written it in marker on a piece of notebook paper, but it offers a broad example of helpful tips for how consumers can see their bills reduced, sometimes dramatically.

"Let's do a quick recap. I received a medical bill in the mail. An outrageously expensive one," she starts in one of the videos, flashing the sheet of paper with $20,000 written on it. "I called and asked for an itemized bill, and got this," she continues, flashing a new sheet of paper with just $3,000 written on it.

In her video, she writes a disclaimer that not all calls will quickly result in such a large decrease, but her larger point remains: Don't pay the first hospital bill that comes in the mail.

"It's the people who are in the middle who can't qualify for financial assistance because they make too much but they don't make enough money to afford insurance and deductibles and copayments," Calderilla said. They all add up and that's a big problem." In North Carolina, more than 1.1 million people without any health insurance live every day knowing they could face a devastating medical bill.

"It's that population that's at highest risk because they're not 'poor' enough to qualify for assistance, but they don't have enough to purchase insurance," Calderilla said. "They're the ones falling through the cracks of the health care system."

Those in the middle aren't the only ones who could be facing large bills. There are more than 6.8 million North Carolinians with private health insurance who could also receive extensive and expensive bills after seeking medical care.

"It impacts someone across their whole life and it creates a cycle that they can't get out of," said Cerese with the North Carolina Justice Center.

What's more, those bills could differ widely depending on where the patient goes for care. And in some cases, more costly care does not equate to better outcomes.

"Nobody should go broke because they got sick," Cerese said. "No one should go into debt because they got sick or had an accident, especially in the richest country in the world."

WUNC AAAS Mass Media Fellow Adithi Ramakrishnan contributed to this story.