Rebecca and Mike Cole are Asheville transplants like so many others.

Tech workers with portable jobs, the Coles, both 52, moved in August from Austin and bought a $1.4 million house near Arden and a lot on which they hope to build on Asheville’s Reynolds Mountain.

Asheville rose to the top of their relocation choices after a series of weekend exploration trips.

“We had decided that Austin was getting too big, and the cost of living was getting too high,” Rebecca Cole said.

“We said, ‘Let’s just start looking around,’” she said. “We randomly came to Asheville and just fell in love.”

It wasn’t entirely random.

Cole remembers seeing Asheville touted as “a really good retirement community,” and landing on a lot of “best places to visit” lists. A seed was planted, thanks in part to the Buncombe County Tourism Development Authority’s marketing juggernaut.

The TDA and its subsidiary, Explore Asheville, have long touted the power of their marketing for attracting tourists, but what isn’t as well known is how that marketing has contributed to the soaring cost of housing.

The TDA, mandated by state legislation to spend two-thirds of its budget promoting the Asheville area for tourism, has long targeted affluent travelers from the Southeast, especially Florida, according to the authority’s annual reports. In the past decade-plus, the TDA expanded those efforts nationwide.

For instance, the 2007-08 annual report sought to, “Concentrate message delivery against a core audience of women 35-64 with a household income of $100,000-plus.” The “typical Asheville visitor” that year was reported to be in their 50s, “traveling as a couple, income of $100,000 or more…”

In the 2011-12 annual report, the authority listed several “Target groups” for its marketing efforts, including “Aging upscale” — people aged 45-65 and up, with “upper middle-plus incomes” and “net worth $250,000-$1 million.” Other target groups included “Mature Wealth,” with a net worth of $1-$2 million, and “Boomer Barons,” those aged 36-55 with “wealthy and affluent incomes.”

The TDA has spent more than $100 million marketing Asheville just since 2017.

A benefit of all that advertising, besides an ever-increasing stream of visitors, is a boost in “the image of Asheville as a place to live, start a career, start a business, go to college, have a second home, or retire,” according to one TDA report on the effectiveness of its marketing.

The TDA calls it a “halo effect,” the notion that consumers with awareness of its advertising are more positive about Asheville “as a place to live, work or retire.”

The TDA’s figures on “Visitor spending on second homes” show the value of that spending doubled from 2009 to 2017, from $44.6 million to $90.4 million. The company that provided TDA the figures changed its methodology in 2017, so the numbers stop there, but the influx of newcomers seems only to have risen during and after the pandemic.

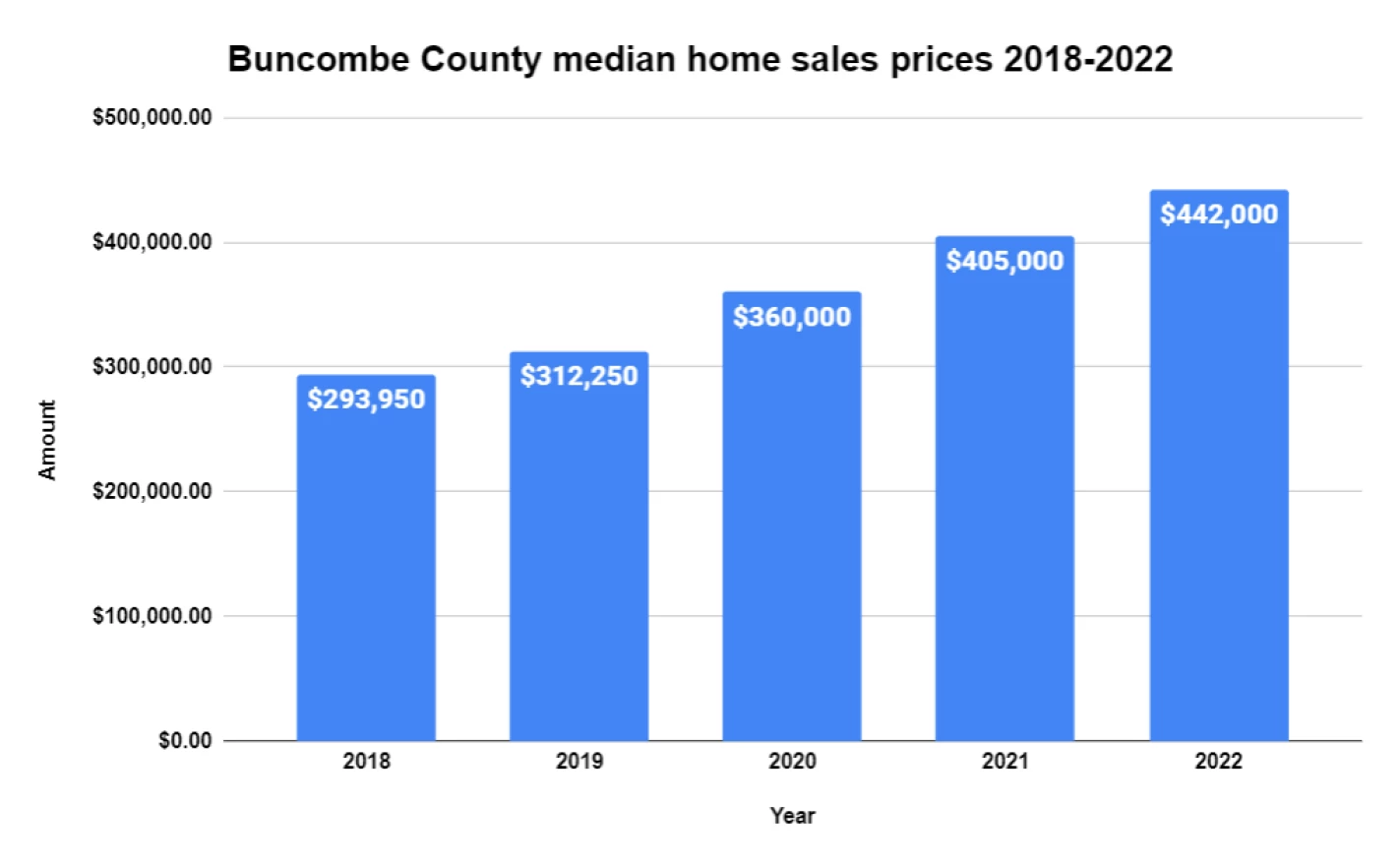

Asheville is one of the costliest places to live in North Carolina, thanks to a dearth of homes, difficult topography to build on, and an influx of people from other states.

Many transplants started out as tourists who hail from many of the same states targeted in TDA advertising and who fell in love with the place, then started looking to buy.

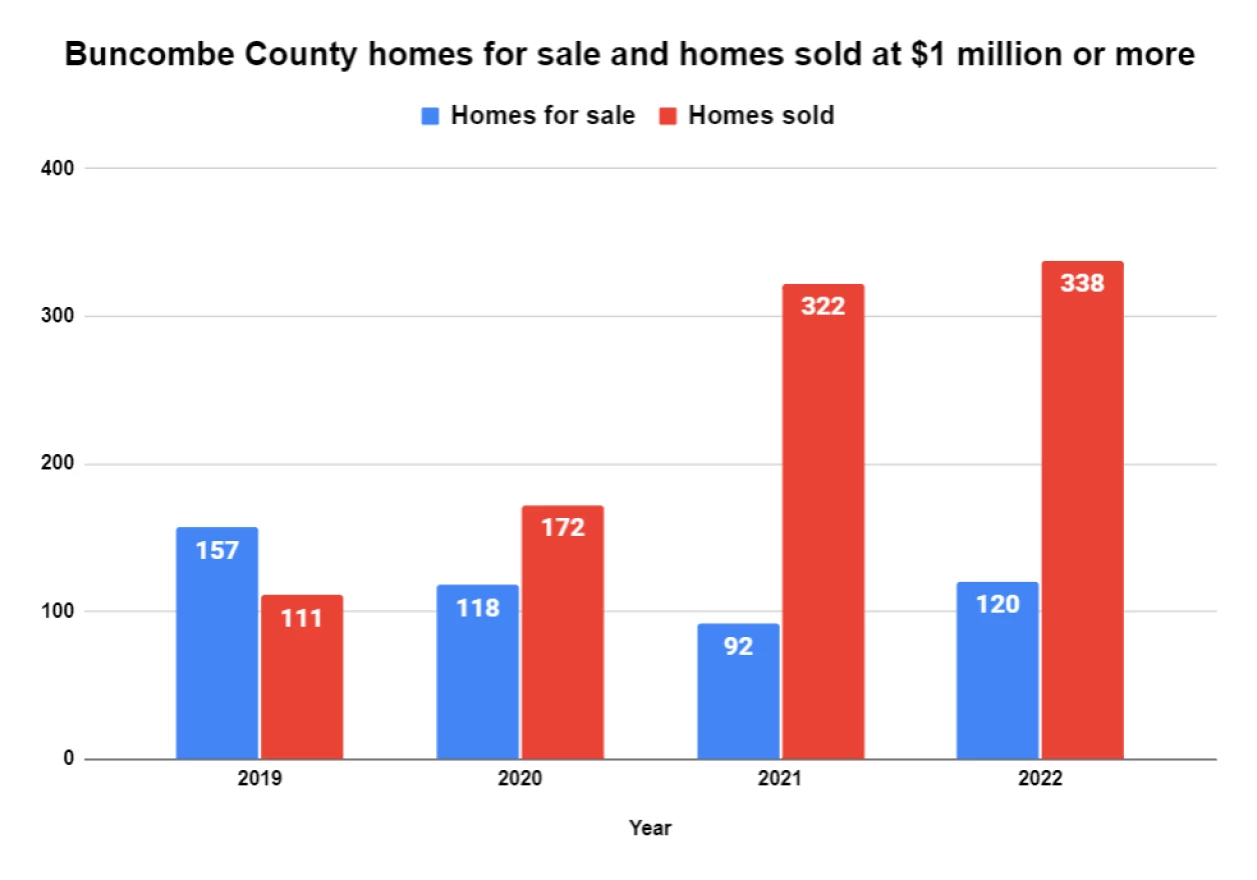

Alessa LeSar, a real estate agent with Clarissa Sells WNC, an EXP Realty company, has sold 15 homes since February. Eleven went to out-of-town buyers, LeSar said, and her last five sales have been to out-of-state cash buyers. Three people bought homes sight unseen and didn’t set foot in their homes until after closing, LeSar said.

“I’m actually standing at a $1.2 million property for a guy in Florida who’s buying to retire here, that he’s never seen,” LeSar said during an interview last month.

Clarissa Hyatt-Zack, the owner of Clarissa Sells WNC/Exp Realty, said her firm “ran about 50/50” last year with out-of-town buyers versus people from the area. She thinks that has trended upward this year.

Typically, Hyatt-Zack said, buyers don’t purchase a home while vacationing.

“They usually vacation here, and then return to the area to home shop, or (they) do virtual tours with us via FaceTime when they get home,” she said.

Beverly-Hanks President Neal Hanks also has seen an influx of out-of-state buyers.

“One of the things that has been evident to me in recent years is that it used to be most folks who came here from out of the state had some sort of connection, some reason to come,” Hanks, mentioning as an example having children in the area. “Now it seems more and more people have researched the areas, and I’m sure the TDA’s efforts have put it on more people’s radar.”

Asked if the influx of out-of-state buyers contributes to rising housing costs, Hanks said, “Sure, I think it does.

“It’s just another piece of the overall demand. We’ve got more demand than we have supply, and that’s why prices keep going up.”

The median sales price for a Buncombe County home in the third quarter was $475,000, up from $450,000 in the same period a year ago, according to the Allen Tate/Beverly-Hanks third quarter real estate report for our region.

ApartmentList.com’s October rent report for Asheville puts the overall median rent at $1,529, after rising 0.7 percent last month. Median monthly rent for a one-bedroom stands at $1,312, and $1,631 for a two-bedroom.

Brownie Newman, chair of the Buncombe County Board of Commissioners and a member of its Affordable Housing Committee, said “there’s definitely a connection between tourism and the fact that we have these rapidly escalating housing costs in Asheville, both on the rental side and on the home ownership side.

“I would say it’s both the fact that many of the buyers of real estate first discovered Asheville as a tourist and then decide to relocate here — that’s a lot of growth pressure we have on the housing market, pushing up prices. And then also the fact that so many properties have been converted away from long-term rentals for people who live and work here to short-term rentals to accommodate tourists, and (that results) in the loss of that supply in the rental market.”

He said the Board of Commissioners plans to submit an application through the TDA’s new Legacy Investment from Tourism fund in hopes that those dollars could help pay for the county’s proposed Ferry Road development, which will include workforce and affordable housing as well as open space and a park.

The Buncombe County TDA via spokesperson Ashley Greenstein sent written responses to questions from Asheville Watchdog. The TDA says the Asheville region, like many places across the country, “has housing affordability challenges due to a lack of housing inventory. Housing affordability is a product of supply and demand.”

The TDA referred to the 2021 Bowen National Research study, “Housing Needs Assessment, Western North Carolina,” which was conducted for Dogwood Health Trust. The report found Buncombe County has a sizable “housing gap” — the number of units needed or that could be supported — both in apartments and houses. For rental units, the gap in Buncombe County stood at 3,669 units, while the gap for owned homes tallied 2,254.

Greenstein maintained that “countless housing units, especially multifamily units” with private financing were “turned away, withdrawn, or voted down in Asheville and Buncombe County over the years.” That, she says, means residents are now “subsidizing housing development with taxpayer dollars through county and city bonds.”

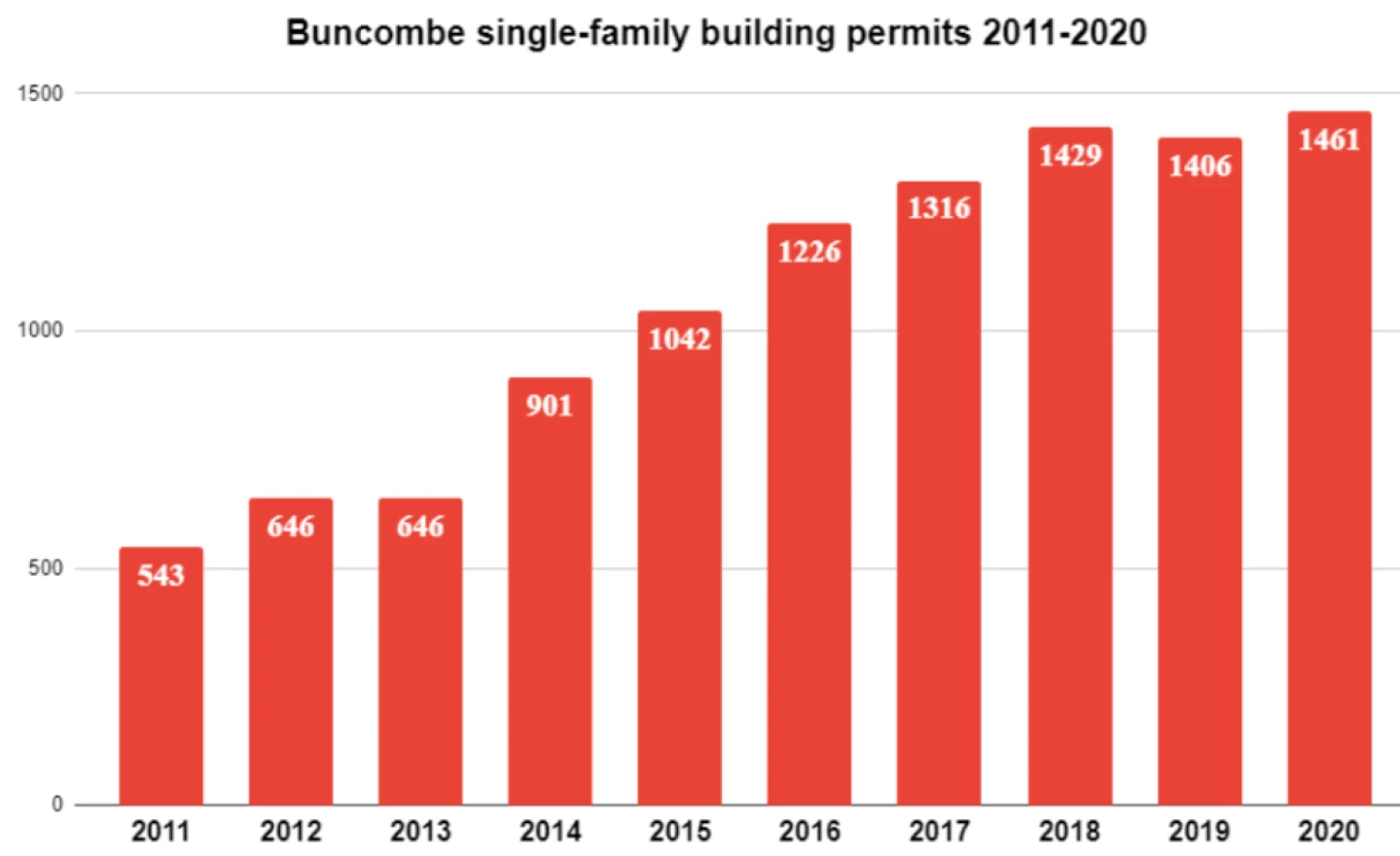

But statistics from the Bowen report show Buncombe had a surge in building after the Great Recession of 2008-09, with permits for multi-family projects (typically apartments) growing from 311 permits in 2015 to 1,196 in 2016 and 1,085 in 2020.

During that time, Buncombe single-family building permits rose from 543 in 2011 to 1,461 in 2020, according to the Bowen report.

The effect of climate

Byron Greiner, principal broker and owner of the Dwell Realty Group based in Asheville, also works as the broker in charge of a short-term rental company. He has noticed the influx of out-of-state buyers, too.

“What I’m seeing is really a migration of folks that are trying to get away from global warming,” Greiner said, adding that “time and time again, our market (for) second homes is almost 80 percent Floridians, and they’re trying to get out of the heat.”

He said he sold his second home in Key West because the annual flood insurance had soared to $15,000.

Those people look to the mountains, as do buyers from Texas, California, and the Northeast, according to several real estate agents.

Mike Figura, founder of Mosaic Community Lifestyle Realty and a developer of a residential neighborhood in West Asheville, pointed out that the trend of out-of-staters moving here has been going on since George Vanderbilt pulled up stakes from New York in the late 1880s and built Biltmore.

He sees the crux of the problem as a lack of housing development, and that’s a national problem. The National Low Income Housing Coalition estimates the U.S. needs 7.3 more million housing units to meet the need.

“If you look at communities that don’t spend as much on tourism, they still have affordable housing issues,” Figura said. “Even in places that tend to have less vibrant economies, their housing costs are still out of line with the cost of living.”

Erin Walton-Haggerty, 30, works as an agent for Mosaic and knows just how tough it is for young people to buy homes in the area. She and her husband, Justin Haggerty, moved here from Austin two years ago, where they rented, and then bought a two-bedroom, one-bath house in Haw Creek — sight unseen — for $315,000.

They’re artists and fell in love with the area, but Walton-Haggerty was working in the restaurant business when they moved and were not flush with cash. Interest rates have since soared, making it especially tough for young buyers to afford a mortgage – and to compete against out-of-state buyers with profits from recently sold homes.

“It’s unfair, especially when there are so many cash buyers coming in from out of state who are older, and just looking for second homes or vacation homes, vacation rentals,” Walton-Haggerty said. “It definitely makes it more difficult.”

Short-term rentals play a role, too

Hanks, the president of Beverly-Hanks, is not in the short-term rental business but said the Asheville region has a lot of housing tied up in vacation rentals, which takes them out of the regular homes for purchase stock. As The Watchdog previously reported, Buncombe vacation rentals in January 2017 numbered 1,555, according to AirDNA, a Denver-based company that provides data and analytics on short-term rentals. By May 2023, that number had rocketed to 5,466.

Meanwhile, long-term rents have soared 65 percent. As The Watchdog previously reported, oversight of these rentals is limited, and there is no publicly available breakdown of who owns them.

“As second homes have become profitable investments for a steady income stream, the housing market at scenic locations and attractions is seeing a price hike, followed by an inventory shortage due to the high demand,” Bridges said, citing a University of Pennsylvania Wharton School of Business academic article. “Over-tourism facilitated by Airbnb and other STRs makes homeowners switch to short-term tenants rather than long-term renters. Hence, the lack of rent control and demand for new properties lead to a price hike and low inventory for homes.”

In the academic article, titled “The Effect of Home-Sharing on House Prices and Rents: Evidence from Airbnb,” researchers Kyle Barron, Davide Proserpio, and Edward Kung state their results “suggest that the increased ability to home-share has led to increases in both rental rates and house prices.”

These increases happen through at least two channels, the researchers found.

The researchers found that “a 1 percent increase in Airbnb listings leads to a .018 increase in rents and a .026 percent increase in house prices.”

Joe Minicozzi, a certified city planner and the principal of Urban3 planning group in Asheville, has worked with client cities throughout the country and previously served as the executive director for the Asheville Downtown Association. Minicozzi said the economics of short-term rentals make them undeniably attractive to investors.

According to AirDNA, vacation rental occupancy in Buncombe County is 57% year to date through September, the TDA said.

Proponents of short-term rentals argue that they can allow homeowners who wouldn’t be able to afford to live here to supplement income and make ends meet.

“Airbnb has allowed Asheville residents to supplement their income and keep up with rising costs of living,” an Airbnb spokesperson said.

An internal 2022 survey of Buncombe County Airbnb hosts found 47 percent of respondents said the income earned through hosting helped them stay in their home, and 58 percent use their extra income to cover basic expenses that have become costlier.

The company also cited independent research that shows “the growth of Airbnb has had an extremely small impact — and in many cases, no impact at all — on rental cost increases,” the spokesperson said.

One AirDNA study of housing affordability and short-term rentals found, “Initial literature that looked at New York and the entire U.S. found a large effect of 17 percent and 20 percent home appreciation due to STRs over a period of about a doubling of STR supply or about four years.”

“Later studies that controlled for market popularity and other variables found a positive but much smaller effect of between 1–4 percent when looking at the entire market and concentrated in very specific touristic areas,” AirDNA found.

The TDA cited a 2021 study, which Land of Sky Realtors commissioned from Smart City Policy Group. “Short-term rentals represent a small fraction of Buncombe County’s housing stock, less than 3 percent of total housing units,” according to the study. “The small share of housing limits the significance and impact STRs have on the region’s housing supply.”

That report also found that spending by short-term rental guests had a “total impact of over $657 million in economic activity,” more than $400 million in annual earnings, and created almost 18,000 jobs last year.

The TDA said the county needs more “thoughtful dense mixed-use development in compact and connected communities to protect the federal, state, and local parks and green spaces that have drawn people here for generations.”

Asheville’s hotel moratorium, which prevented development of new hotels downtown from September 2019 through October 2021, caused an explosion in demand and supply of short-term rentals, Greenstein said. She provided a chart from AirDNA that shows in 2019 hotel rooms comprised 57 percent of the supply and vacation rental rooms 43 percent.

“In 2022 and through the first half of 2023, that has nearly leveled, with 49 percent of lodging supply existing in vacation rental rooms and 51 percent in hotel rooms,” Greenstein said.

Greiner, the real estate agent who also runs a short-term rental company, said the main problem with our housing market is lack of supply.

“People that are buying second homes are paying cash, and they are not affecting the affordability of Asheville,” Greiner said. “The problem with affordability is land prices are expensive, and the interest rates just went over seven and a half percent — that’s jumped almost three quarters of a point, and that’s limited access to first-time homebuyer funds.”

Cole, who just moved to the area last summer from Austin, said she and her husband were surprised by the cost of homes around here, although she realizes they’re at the high end of the market.

“We were hoping to decrease our cost, but we found Asheville more expensive than we thought,” Cole said, adding that they had planned to build on a lot on Reynolds Mountain but construction prices had risen too much.

They bought a four-bedroom, four-and-a- half-bath home that’s about 3,200 square feet. Cole works as a technical business transformation manager and her husband works in finance.

“We couldn’t move here with the job market here,” Cole said. “We heard that from a lot of people — all the people moving here bring their own jobs. We don’t have to stay anywhere, so we thought, ‘Let’s just move ultimately where we want to be and adjust our work from there.’”

Cole acknowledged that some people are going to blame transplants like them for contributing to rising housing costs, especially because they left Austin in part because of wealthy outsiders moving in.

“That’s what happened to us in Austin, so I can definitely see it (happening) here.”

Asheville Watchdog is a nonprofit news team producing stories that matter to Asheville and Buncombe County. John Boyle has been covering Asheville and surrounding communities since the 20th century. You can reach him at (828) 337-0941, or via email at jboyle@avlwatchdog.org. To show your support for this vital public service go to avlwatchdog.org/donate.