North Carolinians who rely on the Affordable Care Act marketplace to buy their health insurance might want to start socking away extra savings for steep rate hikes expected in the coming year.

In the nearly month and a half since President Donald Trump signed the “One Big Beautiful Bill Act,” some of its impacts on monthly household expenses are becoming clearer. When writing the bill, Republicans in Congress chose not to extend tax credits that have lowered monthly health insurance payments for the vast majority of people buying coverage from the Affordable Care Act Marketplace since 2021.

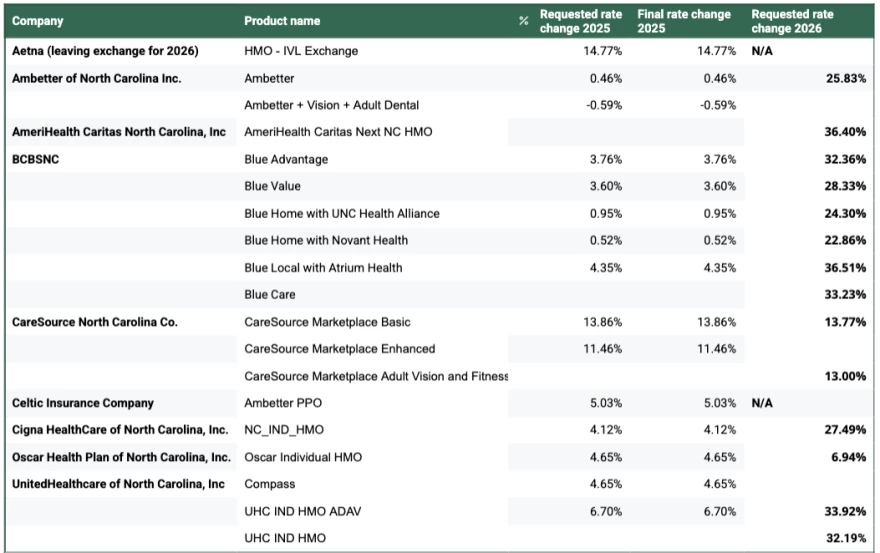

On top of that, the health insurance companies offering marketplace plans have asked the N.C. Department of Insurance for 2026 rate increases that range from 6.9 percent all the way up to an eye-popping 36.5 percent.

They represent the largest premium increase in five years.

“We're looking at like more than a 20 percent average increase (nationally). This is raw premiums, like the base price, without any subsidies added in, just the full price that insurance companies charge nationwide,” said Louise Norris, an analyst with HealthInsurance.org. “North Carolina is even higher than that. It's roughly in the range of about 29 percent.”

Even people who qualify for subsidies will see their monthly premium bills balloon.

More than 15 percent of North Carolinians, or about 1 million people, purchased their insurance for this year on the marketplace. Nationally, about 92 percent of people on the marketplace qualified for tax breaks, which were layered on top of subsidies that get smaller as people’s incomes get larger. Only about 34,000 North Carolinians didn’t qualify for any subsidy and paid full freight for the insurance they purchased through the marketplace.

But everyone buying on the marketplace will face pretty dramatic increases in the coming year.

As a result of these price hikes, local and national analysts predict that there will be a steep drop-off in the number of people who buy marketplace plans for 2026.

These changes roiling the insurance market will affect not only people who buy their insurance on the marketplace, but will have ripple effects throughout the entire population, likely resulting in higher health insurance costs for everyone, analysts say.

Why so expensive?

Like everything else, health care prices are rising due to inflation, and there are newer, pricier drugs like Ozempic that are pushing up expenses. There’s also concern that tariffs will increase the cost of pharmaceuticals, according to the health policy analysis organization KFF.

For millions of consumers, the uptick is because monthly premiums that they’ve been paying have been artificially low for the past four years. In 2021 the American Rescue Plan layered an additional tax credit on top of the subsidies created by the Affordable Care Act that were already in place.

The goal of the tax breaks was to make insurance more affordable and get more people covered during the pandemic.

Those tax breaks were extended in 2023 by the previous, Democratic-controlled Congress, but only until the end of 2025. The low prices drove nationwide enrollment on the marketplace up to a record high of more than 26 million people who purchased coverage this year.

With the subsidies and the tax credits in 2025, a single 50-year-old in Wake County making $40,000 a year is paying an average of $154/ month for insurance, for example. A 30-year-old single parent making the same amount is paying around $61/ month on average, according to scenarios generated by health care policy data analyst Charles Gaba.

Lydia, a 41-year-old single mother of a preschooler from Raleigh who is making about $35,000 a year in food service, said these numbers ring true to her experience (she asked that NC Health News not use her family name). She has had a Blue Cross and Blue Shield of North Carolina plan she purchased on the marketplace for about $50 a month earlier this year, after several years of being on Medicaid.

She said she was grateful for the coverage, which, at first, she thought would be way more expensive.

“I was like, thank God, because it was like, I'm a single mom going through a divorce trying to figure out how to live on my own,” Lydia said. “Then it was like, ‘I can't not have insurance because I have to stay healthy for my myself and my child.’”

Even though Republican budget writers in Congress knew the tax credits that keep these plans affordable were expiring, they chose not to extend them as they crafted the One Big Beautiful Bill Act. This exclusion is one of the things Republican North Carolina Sen. Thom Tillis warned his colleagues about in the runup to the bill’s passage.

Without the tax credits, marketplace consumers will soon see substantial increases in their costs, leading many of those consumers to drop their coverage, Norris said.

According to Gaba’s analysis, that Wake County 50-year-old will end up paying about $258/month, a 67 percent increase. The 30-year-old single parent will end up paying $185/month for coverage, three times what they paid in 2025, unless Congress acts.

Insurers protect bottom lines

Insurance companies are planning for the coming changes. Companies selling ACA plans in North Carolina estimate that only 634,204 people will buy coverage through the marketplace for 2026 — about two-thirds of this year’s total.

“The insurance companies know that when the number of people is reduced due to affordability issues, it tends to be healthier people who drop their coverage,” Norris said. “People who are sick, going through active treatment, have a chronic illness, they really can't afford to drop their coverage.”

All those healthy people dropping out of the insurance pool will result in higher premiums for everyone, she went on to say. With more people uninsured, when they get sick, they end up in hospitals with no way to pay. Hospitals then pass the costs of this uncompensated care along to everyone else, Norris said, causing everyone’s premiums to rise.

“The individual market is all one big market, so it doesn't matter whether you're buying your coverage through the marketplace or directly from an insurance company,” Norris said.

In addition to the sunsetting of the Biden-era tax credits, the new federal spending plan included other rule changes to the ACA marketplace that include:

- A shorter enrollment period starting in 2026.

- New administrative policies that change the way people verify their incomes to receive a subsidy.

- Barring hundreds of thousands of immigrants who are lawfully present in this country from receiving ACA subsidies, even if they would have otherwise been eligible for them.

- And as of the end of August, people who came to this country as children with their immigrant parents and who were granted status in this country under the Deferred Action For Childhood Arrivals (DACA) program will lose marketplace coverage and no longer be allowed to purchase ACA plans.

All of this has the effect of further shrinking and degrading the risk pool of people eligible for marketplace plans. This turmoil in the ACA marketplace, along with new Medicaid and Medicare provisions in Trump’s new federal spending plan, has big insurers revising their earnings projections downward. So, they’re pushing up prices to maintain revenue.

Changes being wrought by the One Big Beautiful Bill Act will have the effect of rolling back much of Pres. Barack Obama's signature Affordable Care Act. For example, in 2025, the average monthly premium before applying subsidies and tax credits was $617 for all of the exchanges nationally, according to federal data. Out-of-pocket costs for those consumers came to an average of $113 after tax breaks were applied, but 70 percent of consumers nationally paid less than $50 out of pocket each month.

That will be much different in 2026.

“Premiums are projected to rise on average at about $670 per person in North Carolina next year,” said Nicholas Riggs, from the NC Navigator Consortium, a group that educates consumers on their insurance options and helps people sign up for plans.

Take away the tax breaks and out of pocket costs will climb even more.

“When it's expensive, you have particularly younger folks who are dropping out of the market. So that creates higher risk pools and more cost for insurance companies,” Riggs said.

Some folks, especially those who are older, can’t forego coverage when prices climb.

Nationally, about a quarter of the people buying from the marketplace are between 50 and 64 years old, too young to qualify for Medicare, but at an age where they start to develop chronic conditions that make health care a necessity — and pricey.

In another scenario, Gaba calculated that a 64-year-old couple in Wake County making about $90,000 a year — just over 400 percent of the federal poverty level — are currently paying around $638/month for coverage. Next year, that same couple will see their premiums skyrocket to more than $2,300/month.

“These factors are affecting rates not just in North Carolina but all across the country,” said North Carolina Insurance Commissioner Mike Causey in a news release. “NCDOI is carefully reviewing the requested rates to ensure that they are supported and meet all statutory requirements.”

A spokesman for the Department of Insurance said that the final rates will be announced by the end of October.

Want to make a comment on the Department of Insurance website? Go to www.ncdoi.gov, scroll to the very bottom and click on Website Feedback.

Local effects

National analysts such as the Commonwealth Fund and the Century Foundation estimate that many of the changes to the marketplace will have an outsized effect in rural areas of North Carolina.

Century Foundation analysts forecast that consumers in counties such as Dare, Hyde, Brunswick, Pamlico and Transylvania will see the highest average loss of premium tax credits, totaling more than a thousand dollars over the course of a year for people who have obtained insurance through the marketplace.

Riggs, from the NC Navigator Consortium, said people are starting to worry.

“The word's gotten out. People are afraid,” he said. “It makes for really difficult conversations. Especially for folks who were trying to prepare for open enrollment and touch base with them. They're afraid of the rate increases. A lot of people are afraid they're not going to be able to afford health coverage.”

Lydia, the Raleigh-based single mom, said she’s just taking it day to day.

“I think if I were younger, I would probably be like, well, let me just not have health insurance for a while. I'm young, I'm healthy, I'll be okay, right?” Lydia said. “Knowing what I know now about mental health and other medications that I need, it's not something I can risk. And so I'm going to have to until I find a new job. I'm going to have to figure it out somehow.”

Riggs said his counselors are directing people to sign up with federally qualified health centers and to explore charity care options like NC MedAssist, which can help people find lower-cost drugs.

“The reality is that losing Medicaid because of their Medicaid expansion going away, or marketplace coverage being unaffordable, there's not really a replacement for that,” Riggs said. “You can supplement different health needs, but full comprehensive coverage is hard to replace with a piecemeal solution.”

This article first appeared on North Carolina Health News and is republished here under a Creative Commons Attribution-NoDerivatives 4.0 International License.

North Carolina Health News is an independent, non-partisan, not-for-profit, statewide news organization dedicated to covering all things health care in North Carolina. Visit NCHN at northcarolinahealthnews.org.