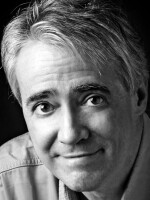

SCOTT SIMON, HOST:

Ukraine receives a much-needed lifeline, an agreement for a $15.6 billion loan from the International Monetary Fund. If approved, it will be the first time the IMF loans to a country at war. We turn now to Scheherazade Rehman, professor of international finance at the George Washington University.

Thanks so much for being with us.

SCHEHERAZADE REHMAN: Thank you.

SIMON: I guess in its entire history - almost 80 years - the IMF hasn't made loans to countries at war. Why do you think they change now?

REHMAN: You know, a rule of banking lending is simple. War poses a risk to the lender, including the IMF, and so they have not done that. This rule change was obviously, you know, politically motivated. But also, the humanitarian need on the ground is quite severe. They basically said they can now lend - there's a new loan program - for countries facing exceptionally high uncertainty. Now, Ukraine was not mentioned at all in this rule change, but clearly, it is targeted for exactly this loan.

SIMON: What is the IMF offering Ukraine?

REHMAN: Well, the package is, as you've mentioned, $15.6 billion. And it's coming in two waves. There's two sides to this. It will eventually be approved by the executive committee of the IMF. And that's a pre-gone (ph) conclusion. They would not have made this announcement if it would not have been officially approved.

The loan itself is actually for 2 1/2 years, but it will unfold in two stages. The first is a year to year and a half will be devoted to building, fiscal, external, price and financial stability. Basically, they'll focus on something called revenue mobilization. Now, this is a usual thing the IMF does. You know, they tell the country, increase your tax collection; eliminate monetary financing; rely on your own domestic debt markets. Now, this is a little bit of, you know, tongue in cheek because a country at war can't do any of these things. But they also have said in this first tranche of money - is that you need to strengthen your governance and anti-corruption framework, because some news has been coming out of Ukraine about corruption of the money coming in.

All these tools for this first batch is also to help Ukraine into the EU, which is one of the major goals. The second phase of the deal, which will last up to the four-year mark, is really designed to entrench macroeconomic stability, support recovery and early reconstruction program while Kyiv, again, tries to achieve the main goal, and that is EU accession.

SIMON: I think you've mentioned a couple, but the IMF is known for attaching conditions. So in this case, the conditions is clean up corruption, improve your governance?

REHMAN: Yeah, and increase tax collection. You know, when they lend money, as you well know, country's already in trouble, and they come with very harsh conditionalities. Everybody is fully cognizant that they're not going to be able to do that, not until this war is over. So this is a lifeline for them to help them humanitarianly, to help their governance and to keep a government in place, with the eventual goal of, when things go back to a new normal, after the war, they will anchor their policies in sustainable financial policies and have a gradual economic recovery and promote long-term growth.

SIMON: I mean, the way you describe it, a loan is being offered with conditions that make Ukraine more likely than ever to qualify for EU membership.

REHMAN: This is exactly setting them on the path. So when they set up these rules and these new macroeconomic policies and so forth, basically, they'll be mirroring what the EU will require.

SIMON: Ukraine was already the IMF's third-largest borrower before the war. What do you foresee for the country's economy when the fighting stops?

REHMAN: Well, let me just backtrack a little bit, you know, in terms of the funding, because the IMF's secondary goal here, which is also a big benefit for Ukraine, is first that it's sending the signal that we are supporting the Ukrainian government, right? And secondly, it's - this loan is expected to mobilize large-scale financing from other international donors and partners, like the one we just recently had last February when Secretary Yellen made a surprise visit to Ukraine - added another $1.2 billion to an already $30 billion gift from the U.S. And that's not counting the military aid, which is about 47 billion just from the United States alone. So they will be continued support. And I believe that, you know, no one can tell how this war is going to end. Obviously, it's going to be a negotiated truce of some kind, but I believe the funding will continue.

SIMON: Do you have any concern that Ukraine can get billions for war that it can't get for recovery?

REHMAN: I think if the war drags on, that is a concern. I believe the EU and the U.S. are so committed to making sure that Ukraine succeeds that the funding will continue. The loan has not been noncontroversial. I mean, it's - we fully understand the Ukrainian need for this relief. But criticism has come in several forms - one that we've heard many times before. There have been many countries at war, and during this time, they have never done this. And the size of the loan is huge. And so, you know, the usual criticism is that it's a Western country, unlike a country, say, in South Asia. Like, Sri Lanka just got a loan, but it had to jump through a lot of hoops...

SIMON: Yeah.

REHMAN: ...And it took quite a while.

SIMON: Or Ethiopia, Eritrea.

REHMAN: Correct.

SIMON: Yeah.

REHMAN: Correct. This also has to do with political agendas and the voting structure of the IMF. You know, the U.S. is the largest shareholder at 16.5%, and everybody else is 6% something and lower. So there's definitely political pressure, especially from the U.S. and the EU, to make all this work and continue to work. So I see more loans ahead.

SIMON: Scheherazade Rehman, professor of international finance at the George Washington University.

Thank you so much for being with us.

REHMAN: Thank you very much.

(SOUNDBITE OF TORTOISE SONG, "TEN-DAY INTERVAL") Transcript provided by NPR, Copyright NPR.

NPR transcripts are created on a rush deadline by an NPR contractor. This text may not be in its final form and may be updated or revised in the future. Accuracy and availability may vary. The authoritative record of NPR’s programming is the audio record.