Updated at 2:38 p.m.

Senate Republicans have released a proposed North Carolina government budget that emphasizes state employee salary increases and puts more in reserves than a similar spending bill from House counterparts.The details released Tuesday by Senate GOP leaders aren't likely to win over Democratic Gov. Roy Cooper about their two-year spending plan or a competing House proposal voted on earlier this month. Both versions contain more corporate tax cuts and don't appear to reach the level of teacher raises Cooper wanted.

Senate budget-writers want to give state employees a base pay raise of 5 percent over the next two years, with supplements for correctional officers and some law enforcement. The Senate plan also uses now-projected surplus funds to raise the state's rainy-day reserves to $2.3 billion by 2020.

What's In

- Average 3.5% raises for public school teachers, an increase that would bring the average annual pay for educators to $54,500; which doesn’t include local supplements.

- A 5% raise for most state employees. The raise – to take place over two fiscal years – would mark the largest bump for state workers in a decade.

- $64 million in funding for the implementation of "Raise the Age." This change, which takes place later in the year, keeps 16 and 17-year-old non-violent offenders largely out of the adult criminal justice system.

- New fees for owners of hybrid and electric vehicles. Lawmakers have said previously considered these fees as a way to make up for lost gas taxes, by owners of more fuel efficient vehicles, to fund the highway trust fund.

- An increase to the standard deduction. Senators want to raise the amount of non-state taxable income for a couple filing jointly to $21,000/annually. The state standard deduction was less than $7,000 when Republicans took over the Legislature eight years ago.

- A reduction of the franchise tax by more than 33%. Their proposal would cut the rate of $1.50 per $1,000 down to 96 cents. According to a release from Senate leaders: “Unlike other taxes, the franchise tax is calculated based on a business’s capital, not its income. That creates a disincentive for businesses to hire new employees, buy new equipment, and expand their facilities.” However, the NC Justice Center is cautioning lawmakers with this proposal. The left-leaning group says such a change could result in a loss of $140 million in annual revenue for the state. The Justice Center notes, “The franchise tax plays a vital role as an alternative minimum corporate tax. If a corporation manages to zero-out its corporate income tax liability because of taxbreaks and loopholes, the franchise tax ensures that corporation will still pay a modest amount of tax to the state to support the state services and infrastructure from which they benefit.

- $3 million funding to have a back log of untested rape kits vetted.

- Funding for a new state park and new trail in Western North Carolina.

What's Out

- Medicaid expansion. It comes as no surprise that the Senate budget writers did not include funding to expand the program to about half a million low income residents. While House Republicans are interested in addressing the coverage gap, and the Governor has repeatedly called for expansion, Senators have yet to demonstrate a willingness to expand, or include the debate as part of the budget process.

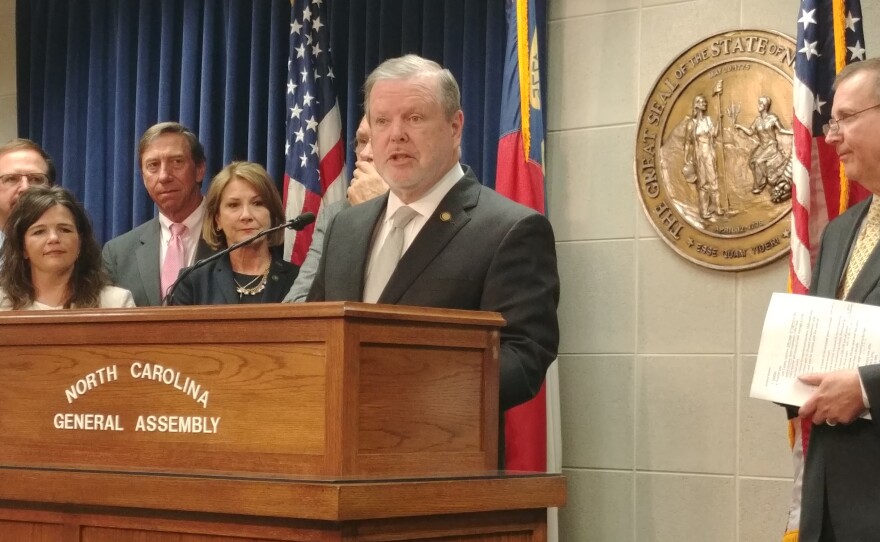

- A cost of living adjustment, or COLA, for state retirees. “We’ve made a conscious decision that making an increase there - we just didn’t have the capacity to do that,” Phil Berger (R-Rockingham) said at a morning press conference.

- Continued, recurring funding for the state’s film grant program. Once a tax break, the film grant program would receive reduced funding, and smaller limits on how much a project could receive.